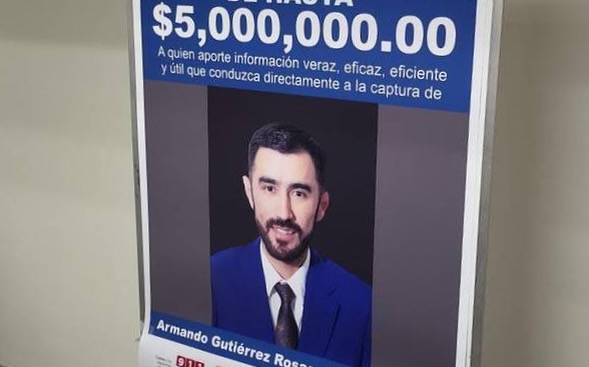

Aras Investment Business Group S.A.P.I. de C.V. and CEO Armando Gutierrez Rosas Accused of Defrauding Over 450 U.S. Investors

SEC charges: In a significant move to protect U.S. investors, the Securities and Exchange Commission (SEC) has taken legal action against Mexico-based company Aras Investment Business Group S.A.P.I. de C.V., its CEO Armando Gutierrez Rosas, and four individuals. The charges allege that they were involved in a fraudulent scheme that raised at least $15 million from more than 450 retail investors in the United States, primarily from the Mexican-American community.

Deceptive Promises and Misused Funds: Unraveling the Ponzi Scheme and SEC Charges

The SEC’s complaint, filed in the U.S. District Court for the Western District of Texas, outlines a complex web of deceit. It alleges that Gutierrez, from approximately March 2020 through November 2021, solicited funds from U.S. retail investors under the false pretense of investing in U.S. real estate and mining operations in Mexico. Promising monthly returns as high as 10 percent, Gutierrez lured investors into his scheme.

However, according to the complaint, none of the funds raised from U.S. investors were used for legitimate investments. Instead, Gutierrez operated a Ponzi scheme and affinity fraud, utilizing investor funds to finance his personal expenses, which included acquiring a lavish $2.5 million mansion in Texas. Alongside Gutierrez, the SEC has also charged Efren Quiroz, Luis Quiroz, Maria Tolentino, and Diayanira Rendon for their involvement in the alleged fraud.

A Commitment to Accountability: Holding Promoters of Affinity Frauds Responsible

Melissa R. Hodgman, Associate Director in the SEC’s Division of Enforcement, emphasized the gravity of the situation, stating, “Our investigation uncovered this egregious fraud that cost the investors involved more than $6 million. We are committed to holding promoters of these types of affinity frauds accountable.”

The SEC’s complaint levels various charges against the defendants, including violating antifraud and registration provisions of federal securities laws. Efren and Luis Quiroz face accusations of acting as unregistered brokers, while Tolentino, along with Efren and Luis Quiroz, is charged with violating registration provisions and aiding and abetting Gutierrez’s and Aras’s violations of the antifraud provisions. Rendon is accused of aiding and abetting Gutierrez’ and Aras’ violations of the antifraud provisions. The SEC’s legal action seeks permanent injunctions, civil penalties, and disgorgement with prejudgment interest.

Acknowledgment of Wrongdoing: Settlements and Consequences

In a significant development, Efren and Luis Quiroz, Tolentino, and Rendon have consented to the entry of judgments against them without admitting or denying the allegations in the complaint. These settlements encompass full injunctive relief against future violations, with disgorgement and penalties to be determined by the court upon motion by the Commission. It is important to note that these settlements are subject to court approval.

Furthermore, Efren and Luis Quiroz have consented to settled Commission orders that prohibit each of them from associating with a registered entity or participating in a penny stock offering.

Investor Protection: SEC’s Office of Investor Education and Advocacy

The SEC’s Office of Investor Education and Advocacy has taken proactive steps to safeguard investors from falling victim to similar schemes. It has issued an Investor Alert with valuable tips on how investors can avoid making investment decisions solely based on common ties with someone recommending or selling the investment.

Behind the Scenes: SEC’s Investigative Efforts

The SEC’s investigation into this case was conducted by Stephen T. Kaiser, with support from Margaret Vizzi. The litigation in this matter will be led by Melissa Armstrong and Mr. Kaiser, and it was supervised by Tim England, Melissa Armstrong, and Ms. Hodgman.

As the SEC takes robust measures to protect investors and bring perpetrators of fraudulent schemes to justice, this case underscores the importance of due diligence and caution when making investment decisions. The SEC’s unwavering commitment to accountability and investor protection remains at the forefront of its mission.